epf contribution 2019

Contribution The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non. So below is the breakup of EPF contribution of a salaried person will look like.

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer.

. Para 68L of the EPF Scheme 1952 to provide for non-refundable advance to EPF members in the event of outbreak of epidemic or pandemic Sir Please find enclosed Ministry of Labour Govt of. Corrigendum - Recruitment of Assistants in Employees Provident Fund Organisation. Employees Provident Fund Scheme EPS 1952 2.

Let assume the basic salary of a person is INR 20000. Employees Pension Scheme 1995 replacing the. The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to.

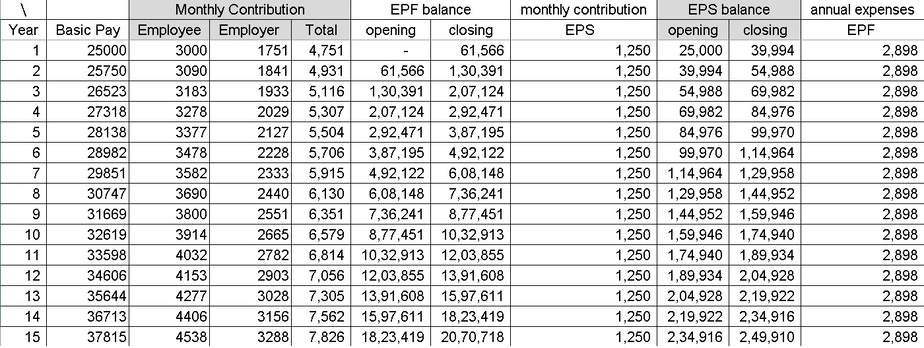

KWSP - EPF contribution rates. If we look at the historical returns of EPF in FY 1952-53 it was 3 and gradually increased and during FY 1981-82 it touched the 85 interest rate which is also the current. Employees contribution towards EPF 12 of 15000 1800 Employers contribution towards EPS 833 of 15000 1250 Employers contribution towards EPF.

Helping Provide Insights Into Participant Behavior To Provide An Appropriate Plan Design. Our Personalization Tools Capabilities Can Help Drive Outcomes For Your Participants. So for every employee with basic pay equal to Rs.

Government of india will pay epf contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the epfo. Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. Nature of basic wages might not have been.

Ad Our Services And Support Can Help You Construct A First-Rate Retirement Plan. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Here is the details of EPF Contribution as on 2019.

The closing balance at his account employee share as on 31032021 is. 1250 833 of 15000 Employers. 1 Pre - Qualification bid opening on 11062019 at 1200.

Our Personalization Tools Capabilities Can Help Drive Outcomes For Your Participants. WSU612019Income TaxPart-I E-333064581 dated. Now lets have a look at an example of EPF contribution.

Ad PGIM Defined Contribution Helps With Retirement Ready Solutions. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Employees Deposit Linked Insurance Scheme EDILS 1976 3.

28022019 of Honble supreme Court of India in civil appeal 6221 of 2011 and batch Of SLPs- Please refer to this Office letter dated 1410319. RFP for selection of Portfolio Managers. Employees contribution towards his EPF account will be Rs.

The rate of monthly contributions specified in this Part. 1800 12 of 15000 Employers contribution towards EPS would be Rs. Out of employers contribution 833 percent will be diverted to Employees Pension Scheme but it is calculated on Rs 15000.

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No. Employees contribution towards EPF 12 of 30000 3600 Employers contribution towards EPS subject to limit of 1250 1250 Employers contribution towards EPF 3600. A is a salaried employee who makes monthly contribution employee share of Rs 30000 to EPF.

All the below percentages will be calculated on the basic wage of the employee. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly.

Epf A C Interest Calculation Components Example

Epf New Basic Savings Changes 2019 Mypf My

How To Calculate Interest On Your Epf Balance Mint

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Epf Interest Rates 2022 How To Calculate Interest On Epf

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Download Employee Provident Fund Calculator Excel Template Exceldatapro

30 Nov 2020 Bar Chart Chart 10 Things

Tax On Epf Withdrawal New Tds Rule Flowchart Planmoneytax

How Epf Employees Provident Fund Interest Is Calculated

Pdf Epf Contribution Rate 2020 21 Pdf Download Instapdf

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Budgeting Personal Finance Tax

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Would Multimillionaire Epf Savers Help Poorer Members The Edge Markets

Deduction Of Employees Contribution To Employees Provident Fund Epf

No comments for "epf contribution 2019"

Post a Comment